Planning for retirement can feel overwhelming, especially if you got a late start or had a few detours along the way.

You’re not alone – according to a recent survey, only 21% of workers feel very confident they’ll have enough money to live comfortably in retirement, while 32% admit they’re not confident at all.

Thankfully, there’s a powerful tool that can help older workers catch up on their savings – literally.

What are catch-up contributions?

Congress introduced catch-up contributions back in 2001 to help workers ages 50 and older make up for lost time. If you qualify, this provision lets you contribute more to your retirement accounts than younger workers can.

Here’s how it breaks down for 2025:

- The standard 401(k) contribution limit is $23,500

- If you’re age 50 or older, or will turn 50 this year, you can contribute up to $31,000

- If you’re between ages 60 and 63, you can go even further – up to $34,750

That’s a significant boost in your tax-deferred savings potential.

Why it matters

An extra $7,500 – or more – each year can make a big difference in the long run. Over time, it could mean tens, or even hundreds of thousands of dollars more in your retirement account. And when you retire, that larger balance could translate into more monthly income – or a longer-lasting nest egg.

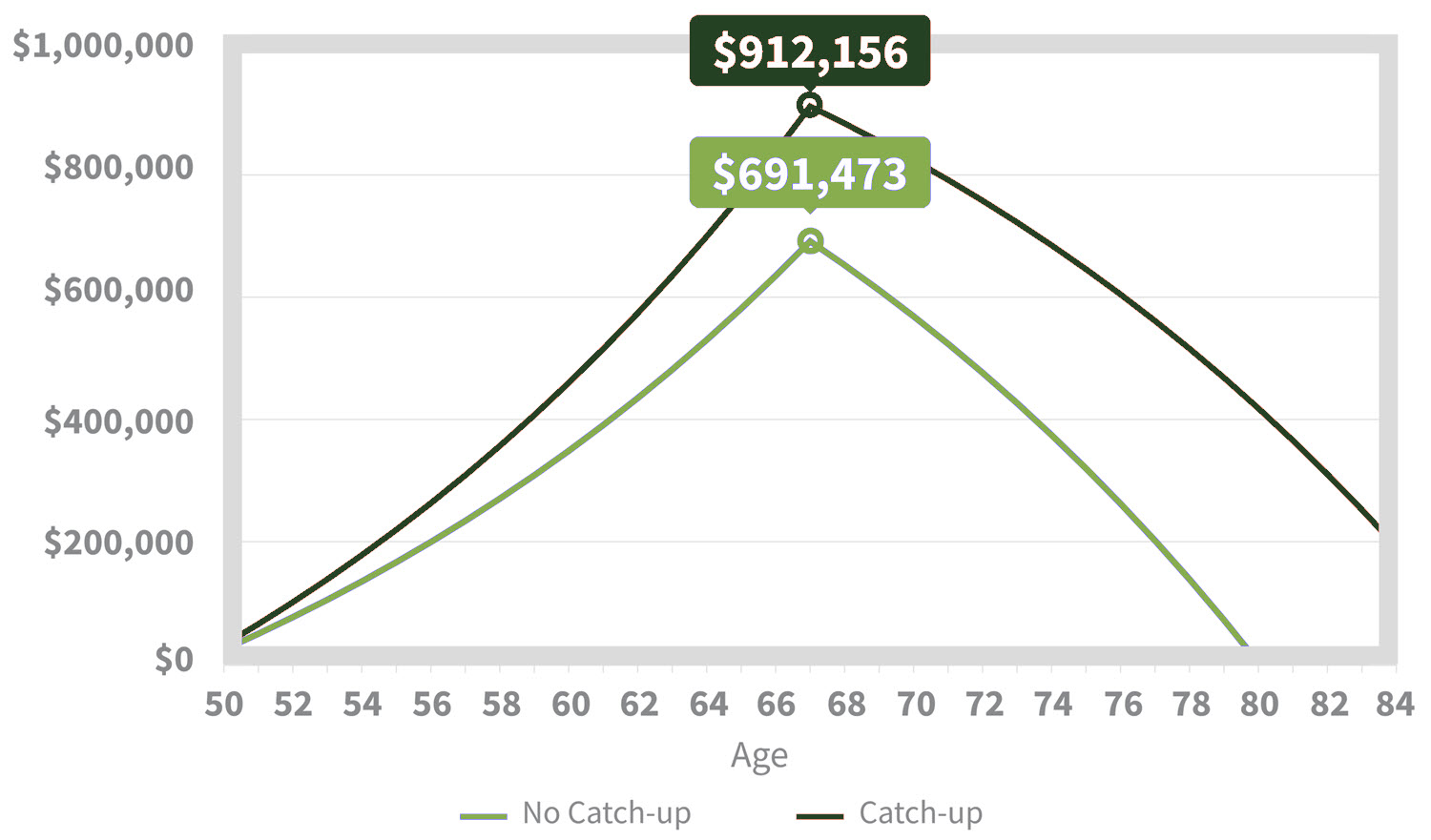

To give you an idea: let’s say two people each contribute to their 401(k) from age 50 to 67. One sticks with the standard limit of $23,500, while the other takes advantage of catch-up contributions and puts in $31,000 annually. When they both retire at 67 and begin withdrawing $7,000 per month, the person who didn’t use catch-up contributions could run out of money before age 80. Meanwhile, the person who saved more will see their funds last significantly longer.

Final thoughts

If you’re 50 or older, catch-up contributions offer a smart way to boost your retirement readiness. Limits do change from year to year, so be sure to stay up to date and talk with your financial advisor to make the most of your savings strategy.

Let’s build a stronger financial future together

Reach out to the Rize Wealth team and explore how catch-up contributions could boost your long-term savings.

This hypothetical example is for illustrative purposes only and does not represent actual investment performance. It assumes a 5% annual rate of return, which is not guaranteed and may vary over time. Fees, taxes, and other expenses are not reflected in this illustration and would reduce returns. Contribution limits and tax rules are subject to change. Withdrawals from a 401(k) or similar plan are taxed as ordinary income and may be subject to a 10% federal income tax penalty if taken before age 59½. In most cases, required minimum distributions must begin at age 73. This material is for informational purposes only and should not be considered tax or legal advice. Please consult a qualified professional regarding your individual situation. Sources: EBRI.org (2024), IRS.gov (2025), Economic Growth and Tax Relief Act of 2001.

Los profesionales financieros asociados con LPL Financial pueden discutir y/o realizar transacciones comerciales solo con residentes de los estados en los que están debidamente registrados o autorizados con licencia. No se pueden realizar ni aceptar ofertas de residentes de ningún otro estado. Los valores son ofrecidos a través de LPL Financial (LPL), un corredor de bolsa registrado (miembro de FINRA/SIPC).Los productos de seguros son ofrecidos a través de LPL o sus afiliados autorizados con licencia. El asesoramiento de inversiones es ofrecido a través de Global Retirement Partners (GRP), un asesor de inversiones registrado y una entidad independiente de LPL Financial. Rize Federal Credit Union (Rize CU) y Rize Wealth no están registrados como corredores de bolsa ni asesores de inversión. Los representantes registrados de LPL ofrecen productos y servicios a través de Rize Wealth y también pueden ser empleados de Rize CU. Estos productos y servicios son ofrecidos a través de LPL o sus afiliados, los cuales son entidades separadas y no afiliadas a Rize CU o Rize Wealth. Los valores y seguros ofrecidos a través de LPL o sus afiliados son:

No asegurados por la NCUA o cualquier otra agencia gubernamental

No Credit Union guarantee

No son obligaciones o depósitos de la Credit Union

Pueden perder valor

Rize Federal Credit Union (Rize CU) proporciona referencias a profesionales financieros de LPL Financial LLC (LPL) de conformidad con un acuerdo que permite a LPL pagar a Rize CU por estas referencias. Esto crea un incentivo para que Rize CU haga estas referencias, lo que resulta en un conflicto de intereses. Rize CU no es un cliente actual de LPL para servicios de asesoramiento. Por favor, visita lpl.com.