Planning for retirement can feel overwhelming, especially if you got a late start or had a few detours along the way.

You’re not alone – according to a recent survey, only 21% of workers feel very confident they’ll have enough money to live comfortably in retirement, while 32% admit they’re not confident at all.

Thankfully, there’s a powerful tool that can help older workers catch up on their savings – literally.

What are catch-up contributions?

Congress introduced catch-up contributions back in 2001 to help workers ages 50 and older make up for lost time. If you qualify, this provision lets you contribute more to your retirement accounts than younger workers can.

Here’s how it breaks down for 2025:

- The standard 401(k) contribution limit is $23,500

- If you’re age 50 or older, or will turn 50 this year, you can contribute up to $31,000

- If you’re between ages 60 and 63, you can go even further – up to $34,750

That’s a significant boost in your tax-deferred savings potential.

Why it matters

An extra $7,500 – or more – each year can make a big difference in the long run. Over time, it could mean tens, or even hundreds of thousands of dollars more in your retirement account. And when you retire, that larger balance could translate into more monthly income – or a longer-lasting nest egg.

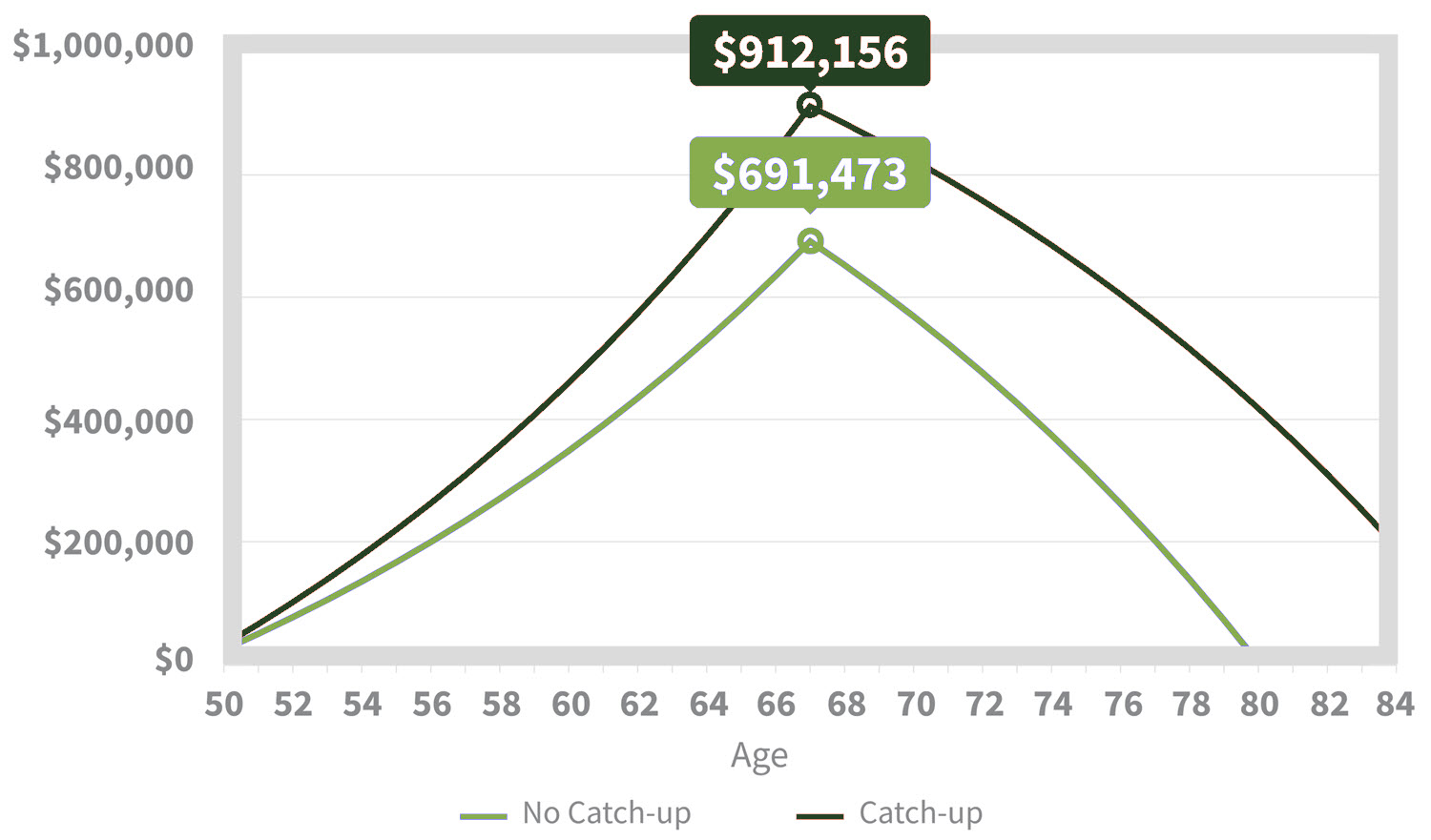

To give you an idea: let’s say two people each contribute to their 401(k) from age 50 to 67. One sticks with the standard limit of $23,500, while the other takes advantage of catch-up contributions and puts in $31,000 annually. When they both retire at 67 and begin withdrawing $7,000 per month, the person who didn’t use catch-up contributions could run out of money before age 80. Meanwhile, the person who saved more will see their funds last significantly longer.

Final thoughts

If you’re 50 or older, catch-up contributions offer a smart way to boost your retirement readiness. Limits do change from year to year, so be sure to stay up to date and talk with your financial advisor to make the most of your savings strategy.

Let’s build a stronger financial future together

Reach out to the Rize Wealth team and explore how catch-up contributions could boost your long-term savings.

This hypothetical example is for illustrative purposes only and does not represent actual investment performance. It assumes a 5% annual rate of return, which is not guaranteed and may vary over time. Fees, taxes, and other expenses are not reflected in this illustration and would reduce returns. Contribution limits and tax rules are subject to change. Withdrawals from a 401(k) or similar plan are taxed as ordinary income and may be subject to a 10% federal income tax penalty if taken before age 59½. In most cases, required minimum distributions must begin at age 73. This material is for informational purposes only and should not be considered tax or legal advice. Please consult a qualified professional regarding your individual situation. Sources: EBRI.org (2024), IRS.gov (2025), Economic Growth and Tax Relief Act of 2001.

The financial professionals associated with LPL Financial may discuss and/or transact business only with residents in the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state. Securities are offered through LPL Financial (LPL), a registered broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Investment advice offered through Global Retirement Partners (GRP), a registered investment advisor and separate entity from LPL Financial. Rize Federal Credit Union (Rize CU) and Rize Wealth are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Rize Wealth, and may also be employees of Rize CU. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Rize CU or Rize Wealth. Securities and insurance offered through LPL or its affiliates are:

Not insured by NCUA or any other government agency

No Credit Union guarantee

Not Credit Union deposits or obligations

May lose value

Rize Federal Credit Union (Rize CU) provides referrals to financial professionals of LPL Financial LLC (LPL) pursuant to an agreement that allows LPL to pay Rize CU for these referrals. This creates an incentive for Rize CU to make these referrals, resulting in a conflict of interest. Rize CU is not a current client of LPL for advisory services. Please visit lpl.com.